By Jeannine Pendergast, CPA

Senior ESOP Client Advisor, Spinnaker Trust

Source: DentistryIQ

Employee stock ownership plans are growing in popularity in other industries and gaining traction among dental practices. Here’s why they have marked advantages over traditional models of succession planning.

A consequence of the rapidly retiring baby boomer generation is a rise in business succession. As this populous generation retires, many of its members must determine how the businesses they’ve built will proceed without them. Dentists and their practices are no different.

However, for business owners contemplating retirement and the succession of their businesses, it’s never just about the money. There are considerations of legacy, brand, culture, family, and employees—how will what they built continue on, or will it continue on?

There is no one solution that will satisfy every business owner grappling with succession. Every circumstance is unique, as are the objectives and desired outcomes. But for practice owners seeking a global solution, employees stock ownership plans (ESOPs) present a very viable option.

ESOPs are growing in popularity in other industries and gaining traction among dental practices for their ability to account for legacy, culture, family, and those who helped build a practice. ESOPs also afford flexibility in transition, allowing owners to exit over time or remain as involved as they prefer in retirement while still establishing a definitive succession.

What are ESOPs?

Technically, an ESOP is a trusts that serves two important purposes:

- To function as a retirement plan for employees

- To provide an exit strategy for ownership that preserves mission, culture, and legacy

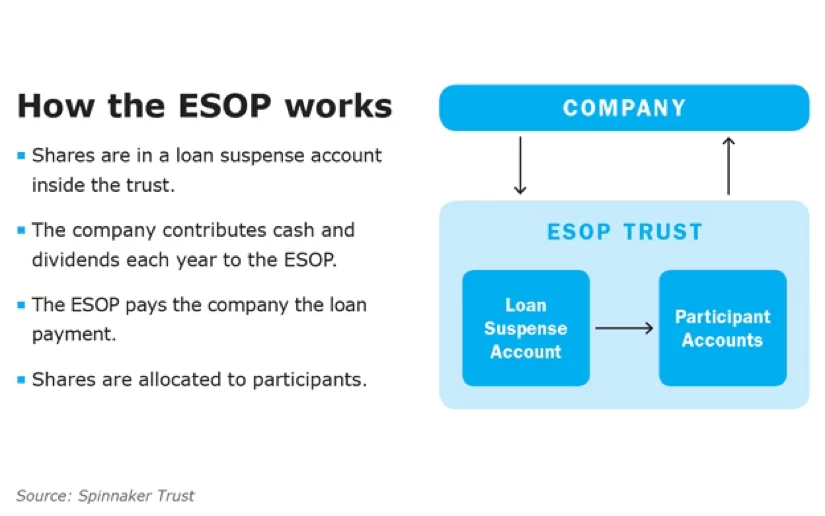

As outlined in the Figure 1, ownership creates an ESOP trust to which the owner sells stock. The trust then pays the owner back over a period of time via a loan. As the loan is paid to the owner, shares are allocated to employees within the ESOP.

Figure 1: How ESOPs work

ESOPs provide substantial tax benefits for owners and the company. However, the governance of the company doesn’t substantially change after the transaction. An owner can remain on the board of directors and be a part of major decisions. Additionally, it gives employees who have helped to build the business an ownership stake. In short, ESOPs are about securing futures—the future of the owner, the future of the business, and the future of the employees.

After the ESOP: Trustee responsibilities

Unlike a sale, setting up the ESOP is the relatively easy part. It’s what comes after the ESOP is established that can prove challenging.

Once an ESOP is established, it must be administered in accordance with the Employee Retirement Income Security Act (ERISA) and the Internal Revenue Service. The ESOP must have a qualified trustee who safe keeps the assets and looks out for the beneficiaries. The plan administrator is in charge of managing the plan, much like a 401(k). Therefore, selecting a qualified trustee is the most important decision to be made in establishing an ESOP.

As a trust, there are fiduciary responsibilities that are best managed by an experienced institutional trustee. A trustee also facilitates the annual valuation process, assumes liability of establishing the stock price, ensures contributions and payments are made on time, reinvests cash balances, works with attorneys to craft amendments to the trust when needed, and works with third party administrators to ensure participants receive statements annually.

Of these responsibilities, the most critical is the annual valuation by an independent third party. It is a time-consuming process for the company and risky for the trustee, because it is ultimately determining the value of the ESOP and therefore the value of the employees’ retirement plans.

New considerations for management must also be acknowledged. Since most ESOPs require debt to purchase the shares, management needs to be aware that they are now running a company that needs cash to pay the debt. They are also now responsible to new owners who are fellow co-workers and beneficiaries of the ESOP.

Additional considerations for management include accounting and tax considerations, company governance, and culture preservation. While these may be viewed as challenges, over time they prove to be advantages. For instance, ESOP companies grow at rates faster than non-ESOP companies due to the increased engagement and participation of employees. Growth figures into the annual ESOP valuation and, in turn, into the value of the employee stock. Company culture is also preserved and even enhanced as employees have more buy-in.

Responsibilities of the business owner

The business owner also has new, albeit welcome, challenges to address. These include asset allocation, estate and gift planning, and expectations. Joining the ESOP Association (esopassociation.org) and the National Center for Employee Ownership (nceo.org) is recommended. Both organizations provide useful resources and support. Establishing the ESOP is only the start, so engaging the proper team of advisors and continually educating yourself is crucial.

Summary

In sum, for practice owners looking for a balanced solution to succession planning, ESOPs present an attractive option. As with any succession plan, challenges exist, but they are all eminently surmountable and do not detract from the value of choosing an ESOP for your succession.